Robinhood Tokenises 500 U.S. Assets on Arbitrum | Bridging TradFi and DeFi

What It Means for Investors

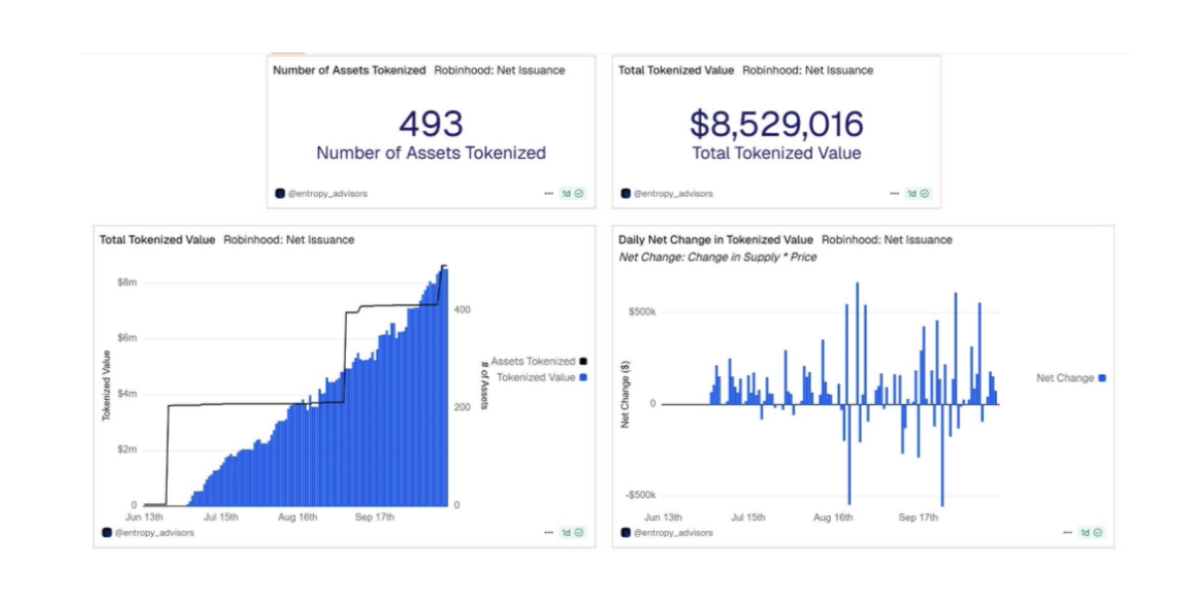

On October 18, 2025, Robinhood expanded its tokenisation efforts by bringing nearly 500 U.S. stocks and ETFs onto Ethereum’s Layer 2 network, Arbitrum, specifically for European users. These tokenised assets have a combined value of approximately $8.5 million, representing a notable step in bridging traditional finance (TradFi) with decentralised finance (DeFi). But why is this significant, and what does it mean for investors and blockchain adoption?

Tokenisation is the process of converting ownership rights of an asset into digital tokens on a blockchain. By doing so, assets such as stocks or ETFs become programmable, easily transferable, and tradable 24/7 without relying on traditional brokerage infrastructures. This approach can increase liquidity, accessibility, and transparency in financial markets, particularly for users in regions where access to U.S. markets is limited.

Robinhood’s initiative demonstrates how a major TradFi player can leverage blockchain to enhance user experience. For EU users, tokenised U.S. assets allow trading on a platform that combines the familiarity of traditional stocks with the speed, efficiency, and programmability of DeFi. By deploying these assets on Arbitrum, a Layer 2 scaling solution for Ethereum, transactions are faster and cheaper compared to the Ethereum mainnet while still benefiting from Ethereum’s robust security framework.

From a market perspective, this move has several important implications. First, it drives fundamental growth for Arbitrum, as the increased transaction volume and on-chain activity improve network utility and adoption metrics. Second, it signals a long-term trend of institutional interest in DeFi infrastructure. When a reputable platform like Robinhood tokenises real-world assets, it legitimizes blockchain as a viable medium for asset ownership and trading.

Tokenisation also has a broader systemic effect. By representing real-world assets digitally, investors can use them as collateral within DeFi protocols, participate in decentralised lending or staking, and integrate them into automated trading strategies. This creates a new financial ecosystem, where traditional assets gain the efficiency, programmability, and composability advantages native to blockchain technology.

However, while the potential is significant, investors should be aware of the differences between tokenised assets and conventional securities. Regulatory frameworks are still evolving, and the legal recognition of tokenised ownership may vary by jurisdiction. Additionally, the value of these assets remains tied to the underlying security, meaning traditional market risks still apply, including price volatility and liquidity constraints.

For users and analysts, the key insight is that Robinhood’s tokenisation initiative represents a hybrid model. It retains the familiarity and trust of traditional finance while introducing DeFi advantages such as instant settlement, fractional ownership, and cross-border accessibility. This model may become increasingly attractive as investors seek diversified access to global markets without conventional intermediaries.

In conclusion, Robinhood’s tokenisation of nearly 500 U.S. stocks and ETFs on Arbitrum is a landmark development in the convergence of TradFi and DeFi. It improves accessibility for EU users, boosts fundamental adoption metrics for Arbitrum, and highlights the growing institutional interest in programmable financial markets. While regulatory and operational considerations remain, the move provides a compelling example of how blockchain can enhance traditional financial products.

This initiative underscores a broader trend: DeFi infrastructure is becoming critical for the future of global finance. As more platforms explore tokenisation, we can expect increased liquidity, transparency, and efficiency in markets worldwide. Investors who monitor these developments are likely to gain early insights into how digital assets and traditional securities may co-evolve, creating new opportunities in trading, investment, and financial innovation.